What Is Trump Taxes Bill 2019 Extra Money

The IRS has released tax data roofing the first thirty weeks of the revenue enhancement season, providing a glimpse of how private taxpayers fared in 2019, the second revenue enhancement twelvemonth under the Tax Cuts and Jobs Act (TCJA). The preliminary data provides aggregate information by income group on a range of topics, including sources of income as well as deductions and credits taken by taxpayers.

Information technology is of import to note that this data represents about 95 percent of filers and excludes those that requested a six-month filing extension. For this reason, the information represents almost 82 per centum of full tax liability that will be reported on individual income taxation returns filed for tax yr 2019.

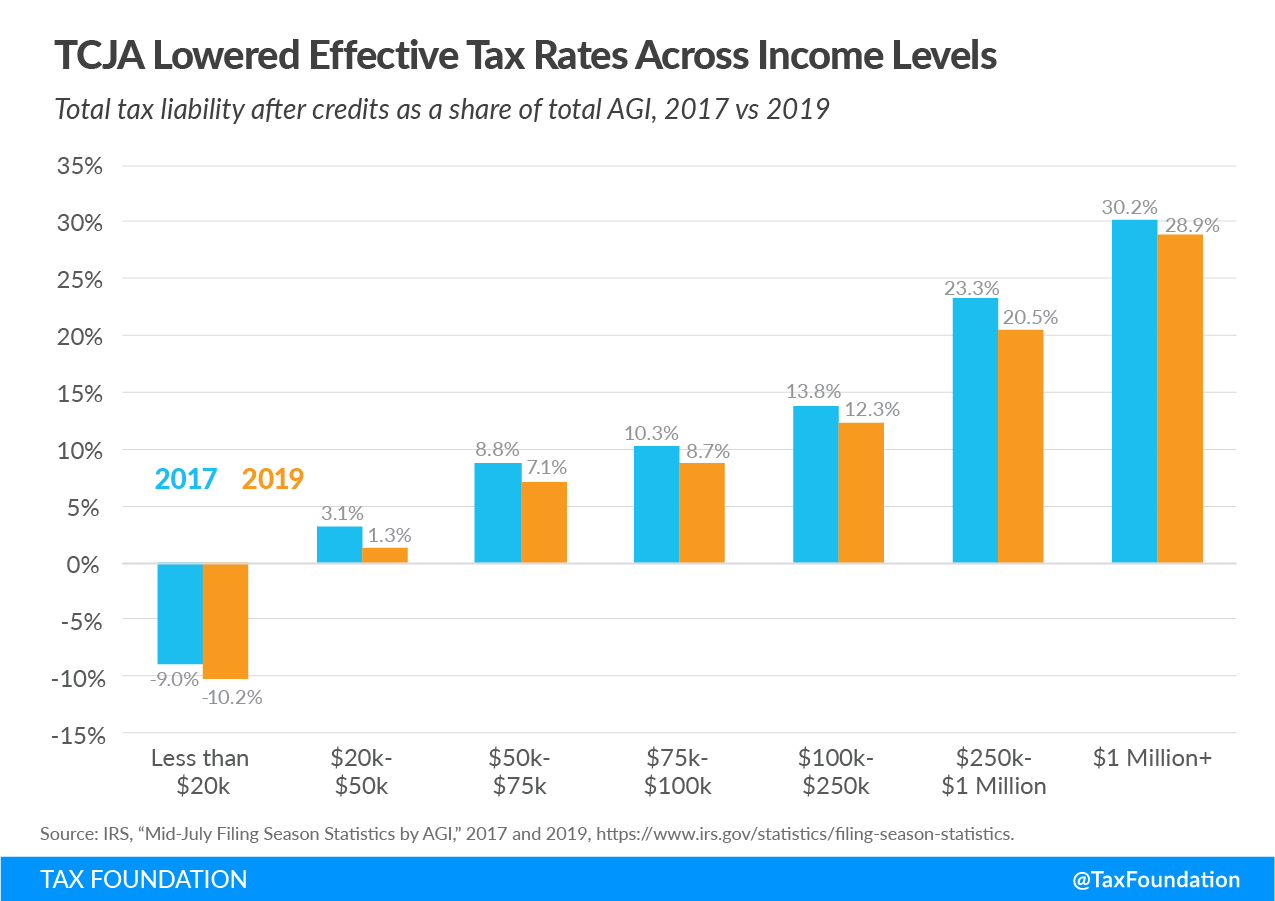

In a previous piece, we outlined how the TCJA reduced effective tax rates and increased use of the standard deduction, among other changes, for all income groups in 2018 compared to 2017. When we account for the 2019 data, a similar trend emerges.

Revenue enhancement Liability

As illustrated below, the TCJA reduced effective tax rates, or total tax liability divided by an income group's total adapted gross income, for all filing groups in 2019 compared to 2017. Even though taxpayers in each income grouping saw a taxation cut on average, individual circumstances vary.

Taxpayers making less than $20,000 experienced negative effective revenue enhancement rates due to refundable tax credits including the Additional Child Tax Credit (ACTC) and Earned Income Tax Credit (EITC). Refundable tax credits allow taxpayers to receive a refund from the government when the amount of credit they are owed surpasses their tax liability.

Filing Methods

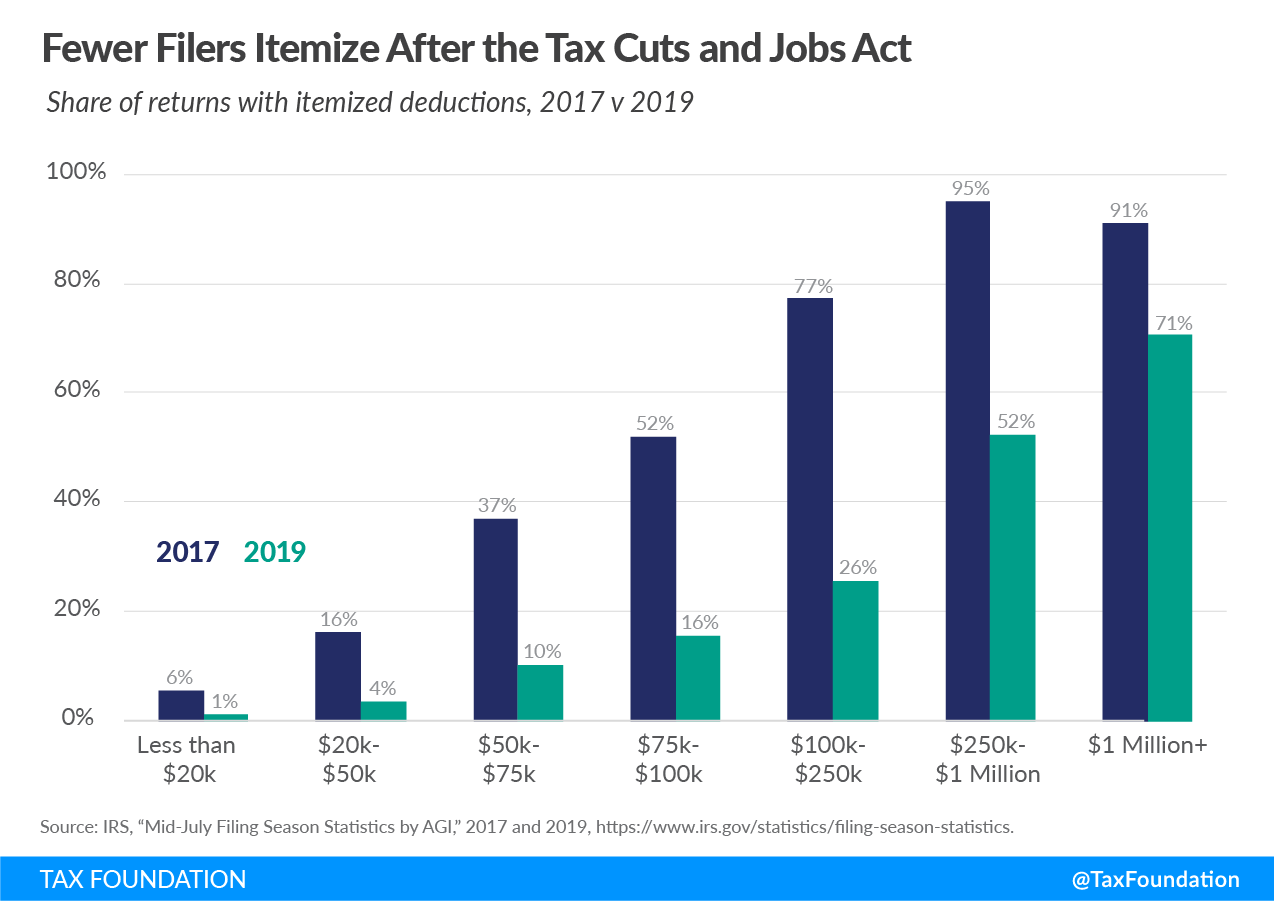

One of the most significant changes introduced past the TCJA was the expansion of the standard deduction. The TCJA also directly limited or eliminated a number of itemized deductions. As the chart beneath shows, the share of taxpayers who itemized went down beyond income levels. According to the returns filed through the starting time 30 weeks of the twelvemonth, 9.6 per centum of filers chose to itemize their deductions on their 2019 tax returns.

Tax Returns and Withholding

Revenue enhancement filing season brings upwardly many questions for taxpayers, such as, "How big will my tax refund be?" or, "Will I have a balance due when I file taxes this year?" Changes to withholding tables in the backwash of the TCJA resulted in lower-than-expected refunds, but it is important to remember that decreased tax refunds do not necessarily interpret to increased revenue enhancement liabilities.

The chart beneath shows the amass amount of refunds returned to taxpayers in each income group through the 30th week of the filing season in 2017 and 2019. While total refunds in 2019 fell for some income groups relative to 2017, effective tax rates dropped beyond all income groups over the aforementioned catamenia. This blueprint is similar to tax year 2018, when aggregate refunds too fell for most income groups.

Kid Tax Credit

The TCJA increased what parents receive from the Child Tax Credit (CTC). The maximum credit corporeality increased from $1,000 to $2,000 per kid and the refundability threshold increased from $one,000 to $1,400. (The refundable portion of the CTC is referred to as the Additional Kid Tax Credit (ACTC).) Additionally, the income level eligibility for the credit increased from $110,000 to $400,000 for married filers ($75,000 to $200,000 for unmarried filers) while the earned income threshold for the ACTC decreased from $3,000 to $2,500. Overall, these changes meant that more filers were eligible for a larger credit.

Equally shown in the chart below, the average combined benefit from the CTC and ACTC rose across all income groups (excluding higher earners who are ineligible for the credit) from 2017 to 2019. Due to the higher income phaseouts, high-income taxpayers saw significantly greater benefits from the credit in 2019 than in 2017. This change and the larger standard deduction helped offset the effects of suspending the personal exemption within the individual income revenue enhancement.

Section 199A Pass-through Deduction

The Revenue enhancement Cuts and Jobs Act of 2017 created a deduction for households with income from pass-through businesses—companies such equally partnerships, Due south corporations, and sole proprietorships, which are not field of study to the corporate income tax. The pass-through deduction allows taxpayers to exclude upwards to 20 percent of their pass-through business income from federal income tax. Upper-income taxpayers are subject to several limits on the deduction, intended to foreclose abuse, which are based on the economical sector of each business organization, the amount of business wages paid, and the original cost of business property.

As illustrated below, in tax yr 2019, income groups of $100,000 and below accounted for 55 percent of the returns challenge the pass-through deduction, just simply twenty.3 percent of the benefits. Income groups higher up $100,000 accounted for 45 percent of returns claiming the pass-through deduction, merely nearly eighty pct of the benefits.

Determination

The data continues to illustrate that the internet upshot of the Revenue enhancement Cuts and Jobs Deed was to reduce effective revenue enhancement rates beyond income groups. In 2019, the TCJA once again expanded the use of several deductions and credits, made the standard deduction more favorable than itemizing, and lowered taxes for near taxpayers.

Source: https://taxfoundation.org/trump-tax-cuts-who-benefited-tax-cuts-and-jobs-act-data-2019/

Posted by: mirelesentils.blogspot.com

0 Response to "What Is Trump Taxes Bill 2019 Extra Money"

Post a Comment