How Much Money Spent On Generic Medication 2016

Prescription drug costs are a pressing business organization for both consumers and policymakers. Rising drug prices bear on patients' out-of-pocket costs also as the budgets of private and public payers, though the challenges vary past payer. This analysis compares prescription drug spending and use in large individual employer plans, Medicare Part D, and Medicaid, based primarily on claims data by payer, which does not account for rebates. Rebates differ by payer, and are estimated to be larger for Medicaid than Medicare Part D or private employers.

Spending by private health insurers, Medicare, and Medicaid accounts for a majority of prescription drug spending in the U.S., but the types of individuals who receive prescription drug coverage from these three payers varies:

- Medicare covers adults ages 65 and older and younger people with long-term disabilities. Medicare's prescription drug benefit is provided through the Part D programme to Medicare beneficiaries who enroll in private stand up-alone drug plans or Medicare Advantage drug plans.

- Medicaid is the nation's wellness insurance plan for people with depression income and provides a broad array of medical and long-term intendance benefits to a diverse population of depression-income children and adults, individuals with disabilities, and people ages 65 and older. People 65 and older and those with disabilities who also have Medicare coverage receive coverage of retail prescription drugs through Medicare Office D.

- Employers cover a population that is healthier than either Medicare or Medicaid, and most all covered workers accept coverage for prescription drugs.

This variation in the types of individuals covered past each payer is reflected in some of the patterns of prescription drug spending and use presented below.

Highlights from this analysis include:

- Private wellness insurance, Medicare, and Medicaid deemed for 82% of total retail prescription drug spending in the U.S. in 2017, while patients paid 14% of the full as out-of-pocket payments.

- For spending on specific drug products, the top 5 drug products with the highest total spending alone account for at least 10% of total prescription drug spending in large employer plans, Medicare Part D, and Medicaid.

- While some of the same drug products appear among the top 10 drug products with the highest total spending in large employer plans, Medicare Part D, and Medicaid, there is also variation that reflects differing covered populations.

- Out-of-pocket drug spending per user amongst people in big employer plans and Medicare Office D is highest for drugs to care for cancer, multiple sclerosis and rheumatoid arthritis.

- Antidiabetic agents, antivirals and psychotherapeutics are among the top therapeutic classes by total spending in large employer plans, Medicare Part D, and Medicaid.

Spending past private health insurance, Medicare, and Medicaid accounts for more than eighty% of full retail prescription drug spending in the U.S.

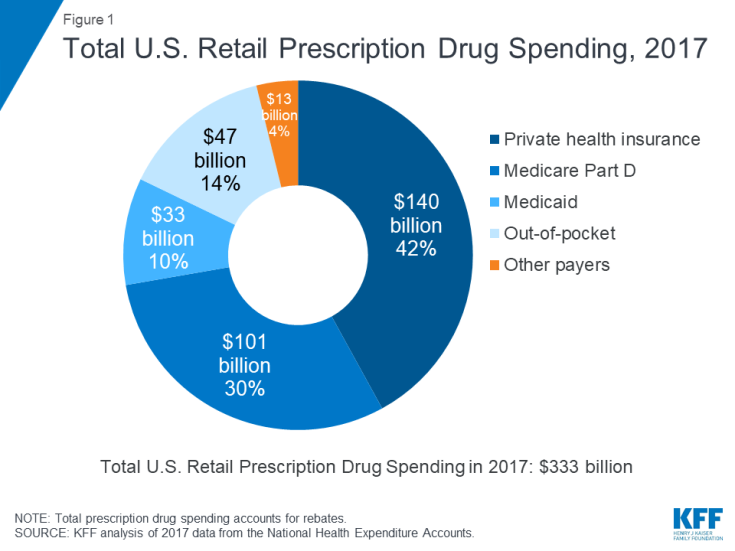

Figure i: Full U.S. Retail Prescription Drug Spending, 2017

In 2017, full U.South. retail prescription drug spending was $333 billion, later accounting for rebates, with the majority (82%) of spending incurred by the three major sources of payment in the U.S. health system: private health insurance, Medicare, and Medicaid. Amidst all payers, individual wellness insurance accounted for the largest share of drug spending, at 42%, followed by Medicare at thirty%, and Medicaid at 10%. Patient out-of-pocket costs represented 14% of total retail drug spending.

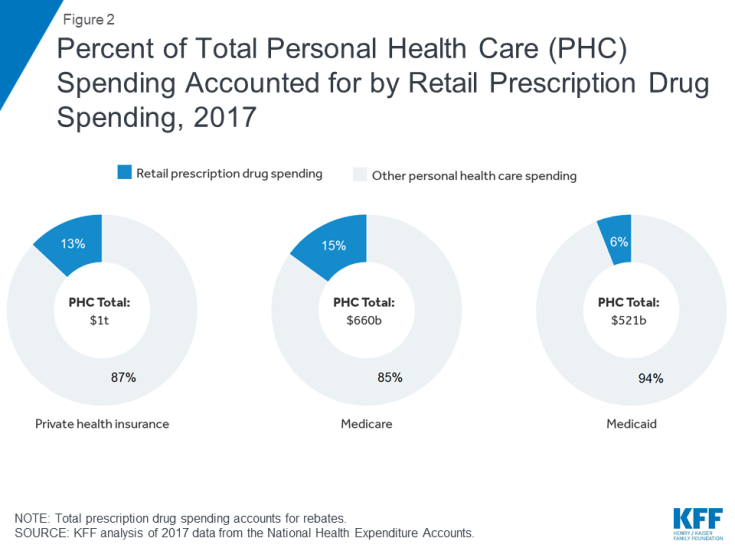

Spending on retail prescription drugs accounts for a larger share of full personal health care spending for private health insurance and Medicare than Medicaid

Percent of Total Personal Health Intendance (PHC) Spending Deemed for past Retail Prescription Drug Spending, 2017

In 2017, retail prescription drug spending accounted for xiii% of total personal health care spending in individual health insurance plans and 15% of personal health care spending in Medicare. Drug spending every bit a share of personal health care spending in Medicaid was lower (6%) because Medicaid also pays for more than expensive services, including long-term services and supports that are non paid for by private insurance or Medicare.

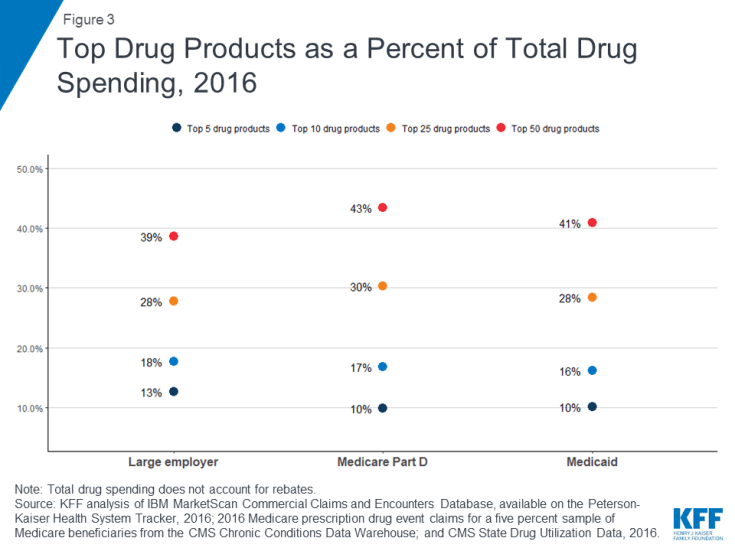

Across payers, a small number of drug products account for a disproportionate amount of full drug spending

Figure 3: Top Drug Products every bit a Percent of Full Drug Spending, 2016

For big employer plans, Medicare Part D, and Medicaid, the top 5 drug products with the highest total spending alone account for at least 10% of full prescription drug spending by each payer (thirteen%, ten%, and x%, respectively), while the top 50 drug products business relationship for roughly 40% of total prescription drug spending (39%, 43%, and 41%, respectively). These estimates do non business relationship for rebates.

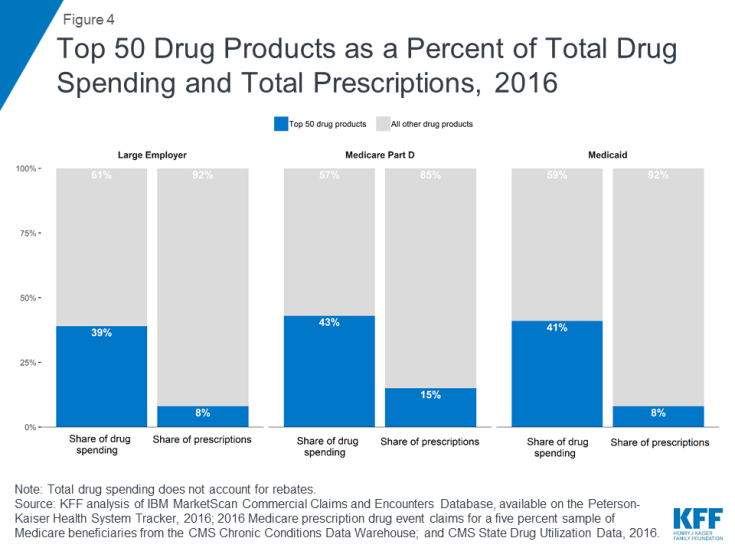

The meridian 50 drug products by spending business relationship for a big share of full drug spending merely a relatively minor share of total prescriptions in big employer plans, Medicare Part D, and Medicaid

Figure 4: Top 50 Drug Products as a Percentage of Full Drug Spending and Total Prescriptions, 2016

While the top fifty drug products account for roughly 40% of total prescription drug spending for big employers, Medicare Part D, and Medicaid, the share of total prescriptions accounted for by the tiptop fifty drug products is much smaller: only 8% for both large employer plans and Medicaid, and 15% for Medicare Part D.

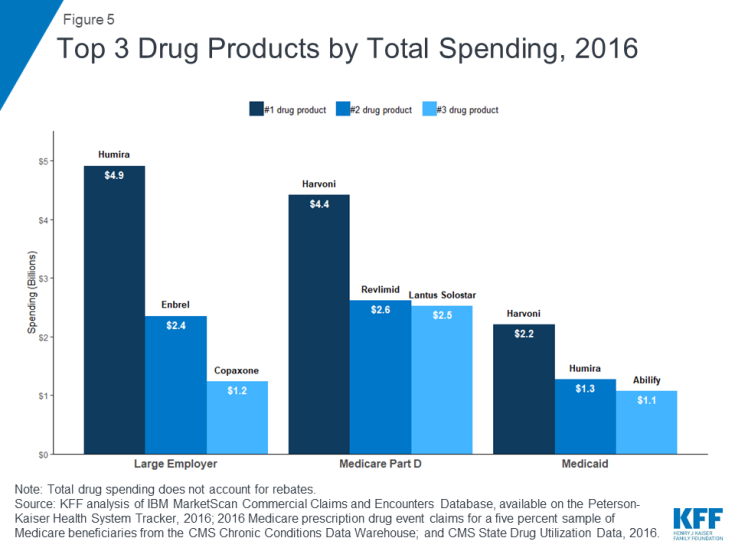

In 2016, total drug spending in Medicare Function D and Medicaid was highest for Harvoni (for hepatitis C); in large employer plans, total drug spending was highest for Humira (for rheumatoid arthritis)

Figure 5: Top 3 Drug Products by Full Spending, 2016

In 2016, the drug production with the highest total spending in Medicare Office D and Medicaid was Harvoni, a curative treatment for hepatitis C that was approved by the FDA in Oct 2014; total spending on Harvoni was $four.four billion in Medicare Part D and $2.2 billion in Medicaid (not bookkeeping for rebates payers may take received). The number one drug product for large employers in 2016 was Humira, a handling for rheumatoid arthritis, with $4.9 billion in full spending (likewise not accounting for rebates).

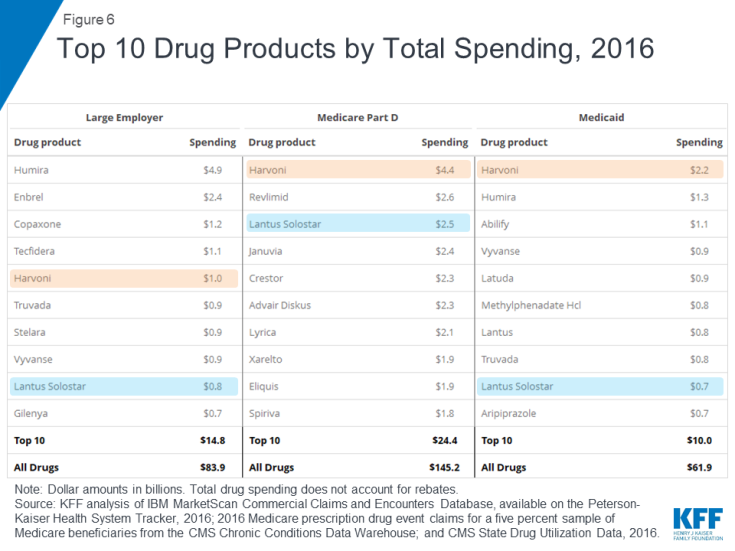

While some of the same drug products announced among the top ten drug products with the highest total spending in large employer plans, Medicare Part D, and Medicaid, in that location is also variation that reflects differing covered populations

Figure 6: Top 10 Drug Products past Full Spending, 2016

Amongst the height x drug products with the highest total spending in large employer plans, Medicare Part D, and Medicaid, there are 2 products in mutual: Harvoni, a treatment for hepatitis C, and Lantus Solostar, an insulin therapy for diabetes. There is additional overlap in the top 10 lists for large employer plans and Medicaid, including treatments for attention-deficit/hyperactivity disorder (ADHD) and HIV. Despite the overlap, the ranking of these drug products generally differs across payers, and there is also variation in which products have the largest full spending for each payer, which reflects the unlike types of populations covered. In item, for Medicare Part D, the summit x listing includes treatments for cancer, chronic obstructive pulmonary illness, and high cholesterol which are more than normally used by older adults. For Medicaid, the top 10 listing includes several psychotherapeutic medications, reflecting the important role that Medicaid plays in meeting the needs of people with mental disease.

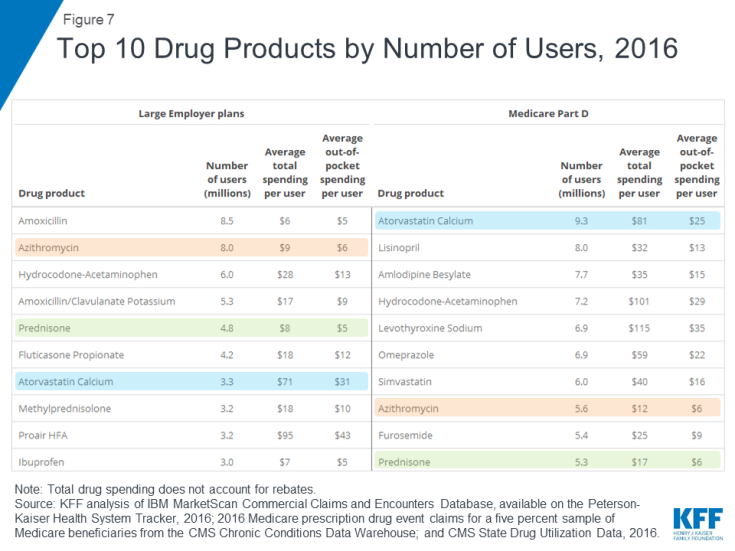

Antibiotics and asthma/allergy drugs are among the about commonly used drugs in large employer plans, while drugs for loftier blood force per unit area and loftier cholesterol are more than unremarkably used in Medicare Role D

Effigy 7: Top 10 Drug Products by Number of Users, 2016

Atorvastatin calcium (generic for Lipitor), a handling for high cholesterol, was used by 9.3 million people in Medicare Part D plans, more users than any other drug product used by Function D enrollees in 2016. The antibiotic amoxicillin was used by eight.5 meg people in large employer plans in 2016, more than than whatever other drug product used by people in big employer plans in 2016. Because the most commonly used drug products are generics, average total and out-of-pocket spending per user is relatively low for these drugs.

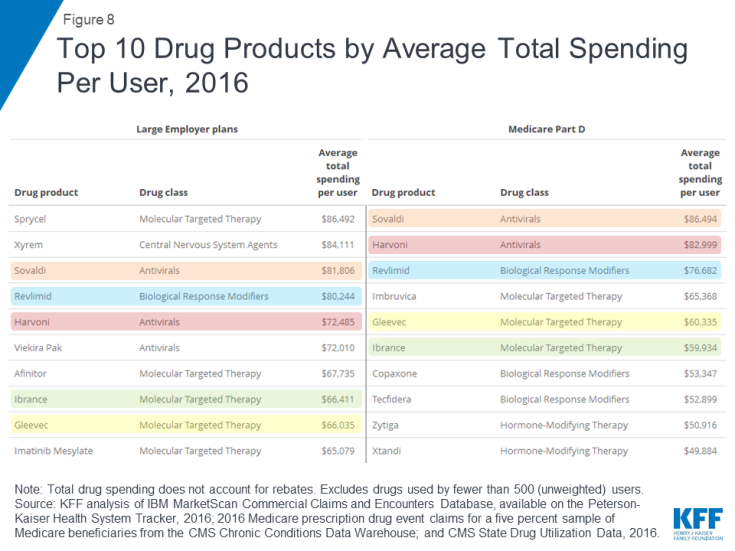

Hepatitis C and cancer treatments have the highest average total spending per user in large employer plans and Medicare Role D

Figure viii: Top 10 Drug Products past Average Total Spending Per User, 2016

Two hepatitis C treatments, Sovaldi and Harvoni, are among the peak 10 drug products by total spending per user in large employer plans and Medicare Role D, with total spending per user on both products of more $70,000 in 2016. Cancer drugs are besides among the drug products with the highest total spending per user for large employer plans and Medicare Part D, including Revlimid, Ibrance, and Gleevec, with almanac costs of at to the lowest degree $60,000 per user.

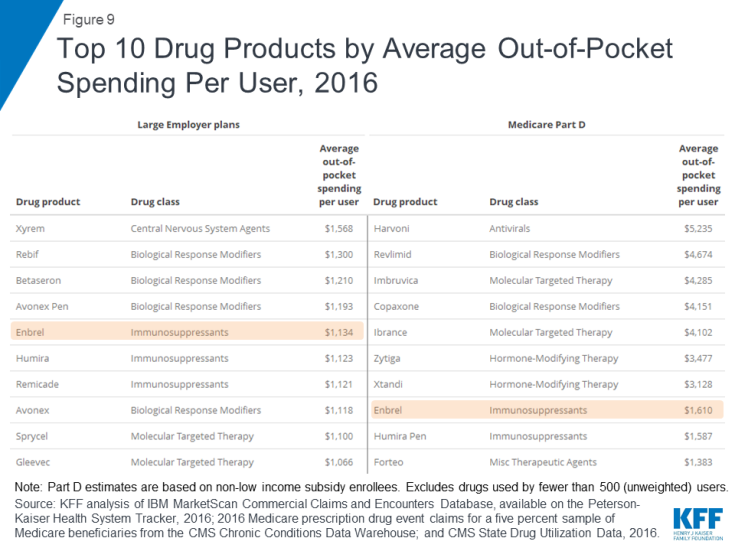

Out-of-pocket drug spending per user among people in large employer plans and Medicare Part D is highest for medications to care for cancer, multiple sclerosis, and rheumatoid arthritis

Figure ix: Acme 10 Drug Products by Average Out-of-Pocket Spending Per User, 2016

Although there is fiddling overlap in the specific list of pinnacle x drug products used by people in large employer plans and Medicare Part D in terms of almanac average out-of-pocket spending per user, the types of drugs with the highest out-of-pocket costs are similar, and include drug products to treat cancer, multiple sclerosis, and rheumatoid arthritis. In 2016, people in large employer plans paid more out of pocket for Xyrem, a treatment for narcolepsy, than for other drug products—$ane,568 on average. In 2016, the hepatitis C treatment Harvoni was the most expensive drug production for Part D enrollees, with $five,235 in average almanac out-of-pocket costs per user among those who did non receive low-income subsidies.

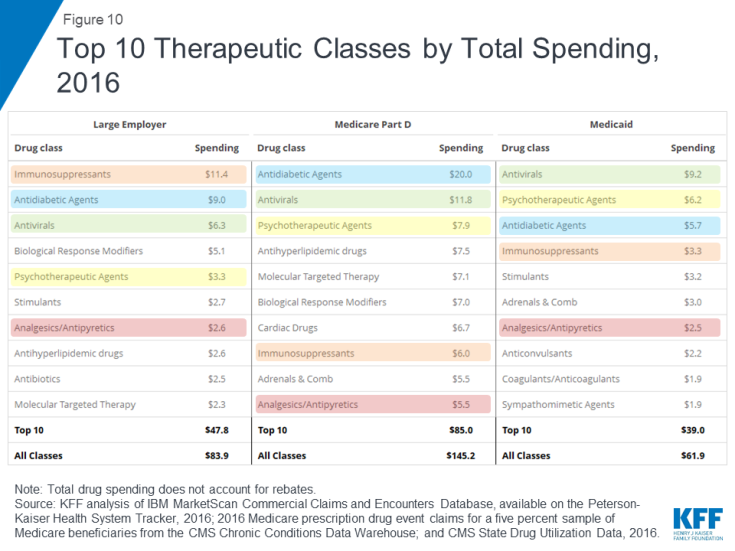

Antidiabetic agents, antivirals, and psychotherapeutics are amidst the top therapeutic classes by total spending in large employer plans, Medicare Function D, and Medicaid

Effigy 10: Top x Therapeutic Classes by Full Spending, 2016

In terms of full spending on prescription drugs by therapeutic grade, antidiabetic agents and antivirals are among the top 3 classes for large employer plans, Medicare Part D, and Medicaid. Total spending on antidiabetic agents, the number one class for Medicare Part D, was $20.0 billion for Function D, $9.0 billion for large employers, and $five.7 billion for Medicaid (not bookkeeping for rebates on drug products in these classes). Total spending on antivirals, the number 1 class for Medicaid, was $9.2 billion for Medicaid, $11.viii billion for Medicare Part D, and $half dozen.3 billion for large employer plans. But as with total spending by drug production, the rankings of superlative drug classes by spending show variation across payers that reflects variation in covered populations; for example, psychotherapeutics rank higher for Medicaid and Medicare Part D than large employers, while molecular targeted therapy (cancer treatments) rank higher for Medicare Role D than big employers.

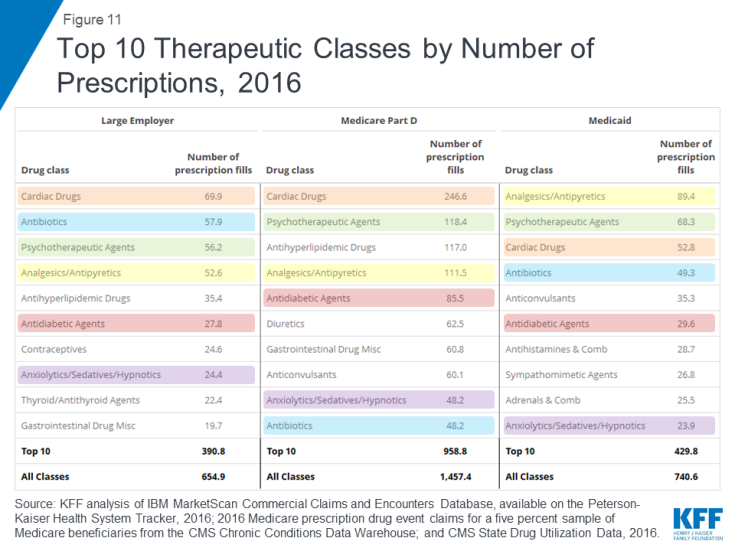

Cardiac drugs, psychotherapeutics, and pain medications are among the top therapeutic classes by volume in large employer plans, Medicare Part D, and Medicaid

Figure 11: Acme ten Therapeutic Classes by Number of Prescriptions, 2016

In terms of number of prescriptions filled, the most commonly used types of drugs in big employer plans, Medicare Function D, and Medicaid include cardiac drugs and psychotherapeutic agents. The number of prescriptions for cardiac drugs—the acme drug class by volume in large employer plans and Medicare Part D—was 69.9 million in large employer plans, 246.6 1000000 in Medicare Part D, and 52.viii one thousand thousand in Medicaid. The number of prescriptions for psychotherapeutic agents—the number two drug course by volume in Medicaid and Medicare Part D and number three in large employer plans—was 56.2 1000000 in large employer plans, 118.4 1000000 in Medicare Office D, and 68.three 1000000 in Medicaid.

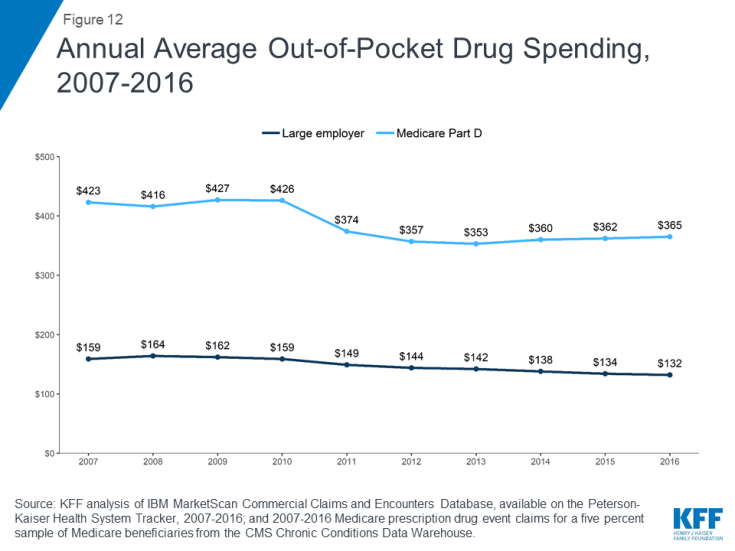

Annual average out-of-pocket spending is college among people in Medicare Part D plans than those in large employer plans, but spending by both groups was lower in 2016 than in 2007

Figure 12: Annual Average Out-of-Pocket Drug Spending, 2007-2016

People in Medicare Part D plans spend more than out of pocket on prescription drugs than people in large employer plans, on average. In 2016, people in Medicare Role D spent $365 out of pocket on drugs, more than than 2.v times the boilerplate out-of-pocket drug spending by people in large employer plans that year ($132). Betwixt 2007 and 2016, average out-of-pocket drug spending past people in large employer plans decreased somewhat. Part D enrollees as well spent less out of pocket in 2016 than in 2007, on boilerplate, only their out-of-pocket costs have been relatively flat since 2012, later on decreasing betwixt 2010 and 2012 due to a provision in the Affordable Care Act to phase out the coverage gap in the Role D benefit.

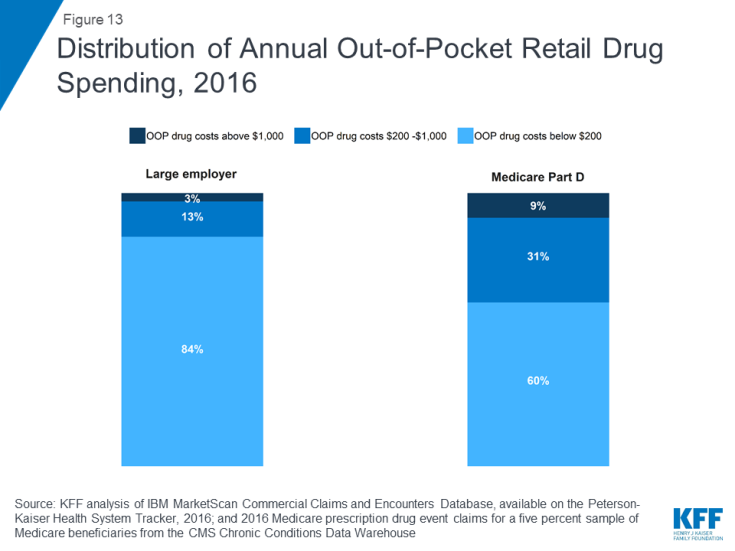

A larger share of people with Medicare Function D accept loftier annual out-of-pocket drug costs compared to people with employer coverage

Figure 13: Distribution of Annual Out-of-Pocket Retail Drug Spending, 2016

In 2016, nearly 1 in 10 people in Medicare Part D plans (9%) had out-of-pocket drug spending above $i,000, compared to three% of people in big employer plans. Conversely, more than viii in ten people in large employer plans (84%) had out-of-pocket drug costs below $200, compared to lx% of people in Medicare Part D plans.

Juliette Cubanski and Matthew Rae are with KFF; Katherine Young was with KFF when the analysis was conducted. Anthony Damico is an independent consultant.

Source: https://www.kff.org/medicare/issue-brief/how-does-prescription-drug-spending-and-use-compare-across-large-employer-plans-medicare-part-d-and-medicaid/

Posted by: mirelesentils.blogspot.com

0 Response to "How Much Money Spent On Generic Medication 2016"

Post a Comment